Page 25 - Admaius 2023 ESGI report

P. 25

How we approach

ESG and impact

Our Commitments Ou r S t r a t e gy Our Portfolio www.admaius.com

Impact methodology

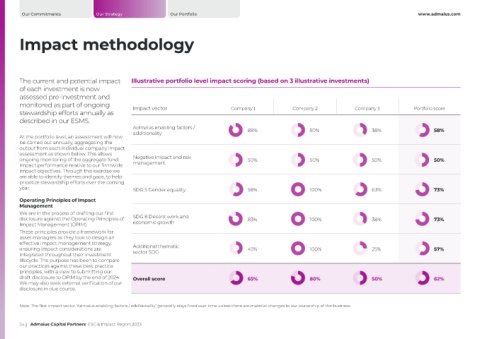

The current and potential impact Illustrative portfolio level impact scoring (based on 3 illustrative investments)

of each investment is now

assessed pre-investment and

monitored as part of ongoing Impact vector Company 1 Company 2 Company 3 Portfolio score

stewardship efforts annually as

described in our ESMS.

Admaius enabling factors / 88% 50% 38% 58%

additionality

At the portfolio level, an assessment will now

be carried out annually, aggregating the

output from each individual company impact

assessment as shown below. This allows

ongoing monitoring of the aggregate fund Negative impact and risk 50% 50% 50% 50%

impact performance relative to our firmwide management

impact objectives. Through this exercise we

are able to identify themes and gaps, to help

prioritize stewardship efforts over the coming

year. SDG 5 Gender equality 58% 100% 63% 73%

Operating Principles of Impact

Management

We are in the process of drafting our first

disclosure against the Operating Principles of SDG 8 Decent work and 83% 100% 38% 73%

Impact Management (OPIM). economic growth

These principles provide a framework for

asset managers as they look to design an

effective impact management strategy,

ensuring impact considerations are Additional thematic 45% 100% 25% 57%

integrated throughout their investment sector SDG

lifecycle. The purpose has been to compare

our practices against these best practice

principles, with a view to submitting our

draft disclosure to OPIM by the end of 2024. Overall score 65% 80% 50% 62%

We may also seek external verification of our

disclosure in due course.

Note: The first impact vector ‘Admaius enabling factors / additionality’ generally stays fixed over time unless there are material changes to our ownership of the business.

24 Admaius Capital Partners ESG & Impact Report 2023