Page 24 - Admaius 2023 ESGI report

P. 24

How we approach

ESG and impact

Our Commitments Ou r S t r a t e gy Our Portfolio www.admaius.com

Climate change

Over 2023 we made the following progress on

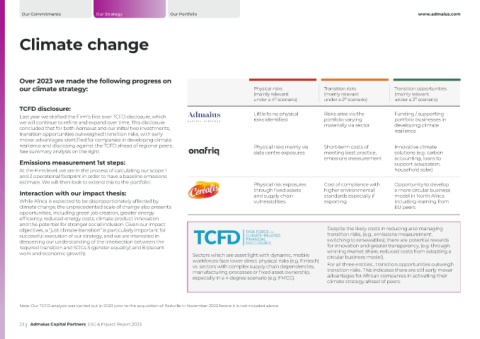

our climate strategy: Physical risks Transition risks Transition opportunities

(mainly relevant (mainly relevant (mainly relevant

under a 40 scenario) under a 20 scenario) under a 20 scenario)

TCFD disclosure:

Last year we drafted the Firm’s first ever TCFD disclosure, which Little to no physical Risks arise via the Funding / supporting

risks identified

portfolio varying

portfolio businesses in

we will continue to refine and expand over time. This disclosure materially via sector developing climate

concluded that for both Admaius and our initial two investments, resilience

transition opportunities outweighed transition risks, with early

mover advantages identified for companies in developing climate

resilience and disclosing against the TCFD ahead of regional peers. Physical risks mainly via Short-term costs of Innovative climate

See summary analysis on the right. data centre exposures meeting best practice, solutions (e.g. carbon

emissions measurement accounting, loans to

Emissions measurement 1st steps: support adaptation,

At the Firm level, we are in the process of calculating our scope 1 household solar)

and 2 operational footprint in order to have a baseline emissions

estimate. We will then look to extend this to the portfolio. Physical risk exposures Cost of compliance with Opportunity to develop

Interaction with our impact thesis: through fixed assets higher environmental a more circular business

and supply chain

model in North Africa

standards especially if

While Africa is expected to be disproportionately affected by vulnerabilities exporting including learning from

climate change, the unprecedented scale of change also presents EU peers

opportunities, including green job creation, greater energy

efficiency, reduced energy costs, climate product innovation

and the potential for stronger social inclusion. Given our impact

objectives, a “just climate transition” is particularly important for Despite the likely costs in reducing and managing

successful execution of our strategy, and we are interested in transition risks, (e.g., emissions measurement,

deepening our understanding of the intersection between the switching to renewables), there are potential rewards

required transition and SDGs 5 (gender equality) and 8 (decent for innovation and greater transparency, (e.g. through

work and economic growth). Sectors which are asset light with dynamic, mobile winning market share, reduced costs from adopting a

workforces face lower direct physical risks (e.g. Fintech) circular business model).

vs. sectors with complex supply chain dependencies, For all three entities , transition opportunities outweigh

manufacturing processes or fixed asset ownership, transition risks. This indicates there are still early mover

especially in a 4 degree scenario (e.g. FMCG). advantages for African companies in activating their

climate strategy ahead of peers.

Note: Our TCFD analysis was carried out in 2023 prior to the acquisition of Parkville in November 2023 hence it is not included above.

23 Admaius Capital Partners ESG & Impact Report 2023