Page 18 - Admaius 2022 ESGI report

P. 18

Admaius Capital Partners’ H o w w e a p p r o a c h

How we approach

ESG and impact

commitments E S G a n d i m p a c t Our portfolio

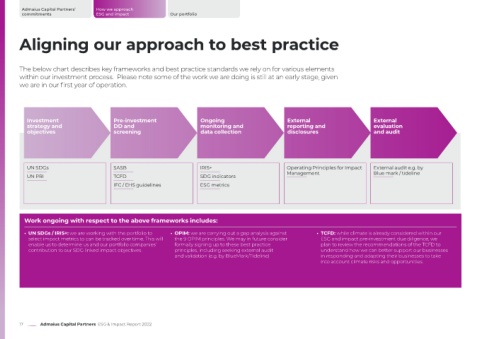

Aligning our approach to best practice

The below chart describes key frameworks and best practice standards we rely on for various elements

within our investment process. Please note some of the work we are doing is still at an early stage, given

we are in our first year of operation.

Investment Pre-investment Ongoing External External

strategy and DD and monitoring and reporting and evaluation

objectives screening data collection disclosures and audit

UN SDGs SASB IRIS+ Operating Principles for Impact External audit e.g. by

Management Blue mark / tideline

UN PRI TCFD SDG indicators

IFC / EHS guidelines ESG metrics

Work ongoing with respect to the above frameworks includes:

• UN SDGs / IRIS+: we are working with the portfolio to • OPIM: we are carrying out a gap analysis against • TCFD: while climate is already considered within our

select impact metrics to can be tracked over time. This will the 9 OPIM principles. We may in future consider ESG and impact pre-investment due diligence, we

enable us to determine us and our portfolio companies’ formally signing up to these best practice plan to review the recommendations of the TCFD to

contribution to our SDG linked impact objectives. principles, including seeking external audit understand how we can better support our businesses

and validation (e.g. by BlueMark/Tideline) in responding and adapting their businesses to take

into account climate risks and opportunities.

17 Admaius Capital Partners ESG & Impact Report 2022