Page 17 - Admaius 2022 ESGI report

P. 17

How we approach

Admaius Capital Partners’ H o w w e a p p r o a c h

commitments E S G a n d i m p a c t Our portfolio

ESG and impact

How we approach ESG and impact integration

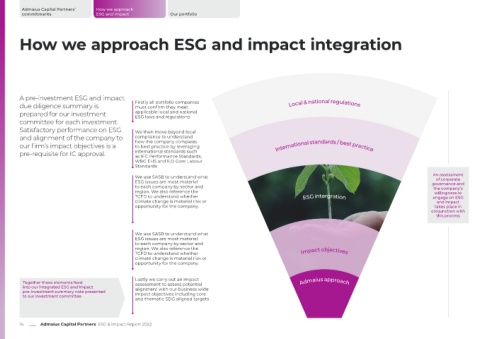

A pre-investment ESG and impact

due diligence summary is Firstly all portfolio companies Local & national regulations

must confirm they meet

prepared for our investment applicable local and national

ESG laws and regulations

committee for each investment.

Satisfactory performance on ESG We then move beyond local

and alignment of the company to compliance to understand

how the company compares

our firm’s impact objectives is a to best practice by leveraging International standards / best practice

pre-requisite for IC approval. international standards such

as IFC Performance Standards,

WBG EHS and ILO Core Labour

Standards

We use SASB to understand what An assessment

of corporate

ESG issues are most material governance and

to each company by sector and the company’s

region. We also reference the willingness to

TCFD to understand whether ESG intergration engage on ESG

climate change is material risk or and impact

opportunity for the company. takes place in

conjunction with

this process

We use SASB to understand what

ESG issues are most material

to each company by sector and

region. We also reference the

TCFD to understand whether Impact objectives

climate change is material risk or

opportunity for the company.

Lastly we carry out an impact

Together these elements feed assessment to assess potential Admaius approach

into our integrated ESG and Impact alignment with our business wide

pre-investment summary note presented impact objectives including core

to our investment committee

and thematic SDG aligned targets

16 Admaius Capital Partners ESG & Impact Report 2022