Page 22 - Admaius 2022 ESGI report

P. 22

Admaius Capital Partners’ H o w w e a p p r o a c h

How we approach

S

G a

n

p

m

E

a

commitments ESG and impact t Our portfolio

c

d i

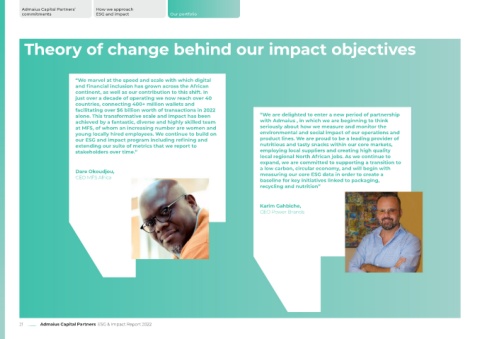

Theory of change behind our impact objectives

“We marvel at the speed and scale with which digital

and financial inclusion has grown across the African

continent, as well as our contribution to this shift. In

just over a decade of operating we now reach over 40

countries, connecting 400+ million wallets and

facilitating over $6 billion worth of transactions in 2022

alone. This transformative scale and impact has been “We are delighted to enter a new period of partnership

achieved by a fantastic, diverse and highly skilled team with Admaius , in which we are beginning to think

at MFS, of whom an increasing number are women and seriously about how we measure and monitor the

young locally hired employees. We continue to build on environmental and social impact of our operations and

our ESG and impact program including refining and product lines. We are proud to be a leading provider of

extending our suite of metrics that we report to nutritious and tasty snacks within our core markets,

stakeholders over time.” employing local suppliers and creating high quality

local regional North African jobs. As we continue to

expand, we are committed to supporting a transition to

a low carbon, circular economy, and will begin with

Dare Okoudjou, measuring our core ESG data in order to create a

CEO MFS Africa

baseline for key initiatives linked to packaging,

recycling and nutrition”

Karim Gahbiche,

CEO Power Brands

21 Admaius Capital Partners ESG & Impact Report 2022