Page 11 - Admaius 2022 ESGI report

P. 11

Admaius Capital Partners’ How we approach

commitments ESG and impact Our portfolio

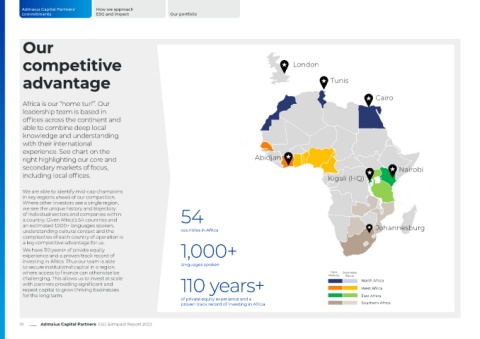

Our

competitive London

advantage Tunis

Cairo

Africa is our “home turf”. Our

leadership team is based in

offices across the continent and

able to combine deep local

knowledge and understanding

with their international

experience. See chart on the Tunis

right highlighting our core and Abidjan

secondary markets of focus, Nairobi Cairo

including local offices. Kigali (HQ)

We are able to identify mid-cap champions

in key regions ahead of our competition.

Where other investors see a single region,

we see the unique history and trajectory

of individual sectors and companies within 54

a country. Given Africa’s 54 countries and

an estimated 1,000+ languages spoken, Johannesburg

understanding cultural context and the countries in Africa Abidjan Nairobi

complexities of each country of operation is 64 Kigali

a key competitive advantage for us.

We have 110 years+ of private equity 1,000+ Current offices

experience and a proven track record of Markets where our heat-not-burn

Future offices

product IQOS is available for sale

investing in Africa. Thus our team is able

to secure institutional capital in a region languages spoken

where access to finance can otherwise be Markets Secondary

Core

challenging. This allows us to invest at scale Focus North Africa

with partners providing significant and 110 years+

repeat capital to grow thriving businesses West Africa Johannesburg

for the long term. East Africa

of private equity experience and a

proven track record of investing in Africa Southern Africa

10 Admaius Capital Partners ESG & Impact Report 2022