Leading by example: best-in-class ESG standards

Admaius will lead by example with best-in-class ESG standards and principles for responsible investment. Working closely with each of our portfolio businesses, we will ensure comprehensive ESG action planning with commitments to implementation, robust compliance reporting and measurement.

Robust governance and ethical standards ensure Admaius is a highly effective and responsible steward of the Virunga Africa Fund I (VAFI). Admaius is led by a truly independent investment team and is advised by some of the leading authorities in their respective fields.

We are institutional

Fully committed to Africa, with an African investment team built on the foundation of an institutional mindset.

These are our home markets we are contributing to impacting.

Capital & Accountability

Our investors and partners are aligned in providing significant and repeat capital to grow thriving businesses for the long term.

That requires financial returns as well as operating performance to get to meaningful scale.

Further, to unlock swift growth and improvement of businesses, the team brings strong expertise, networks and critical technology.

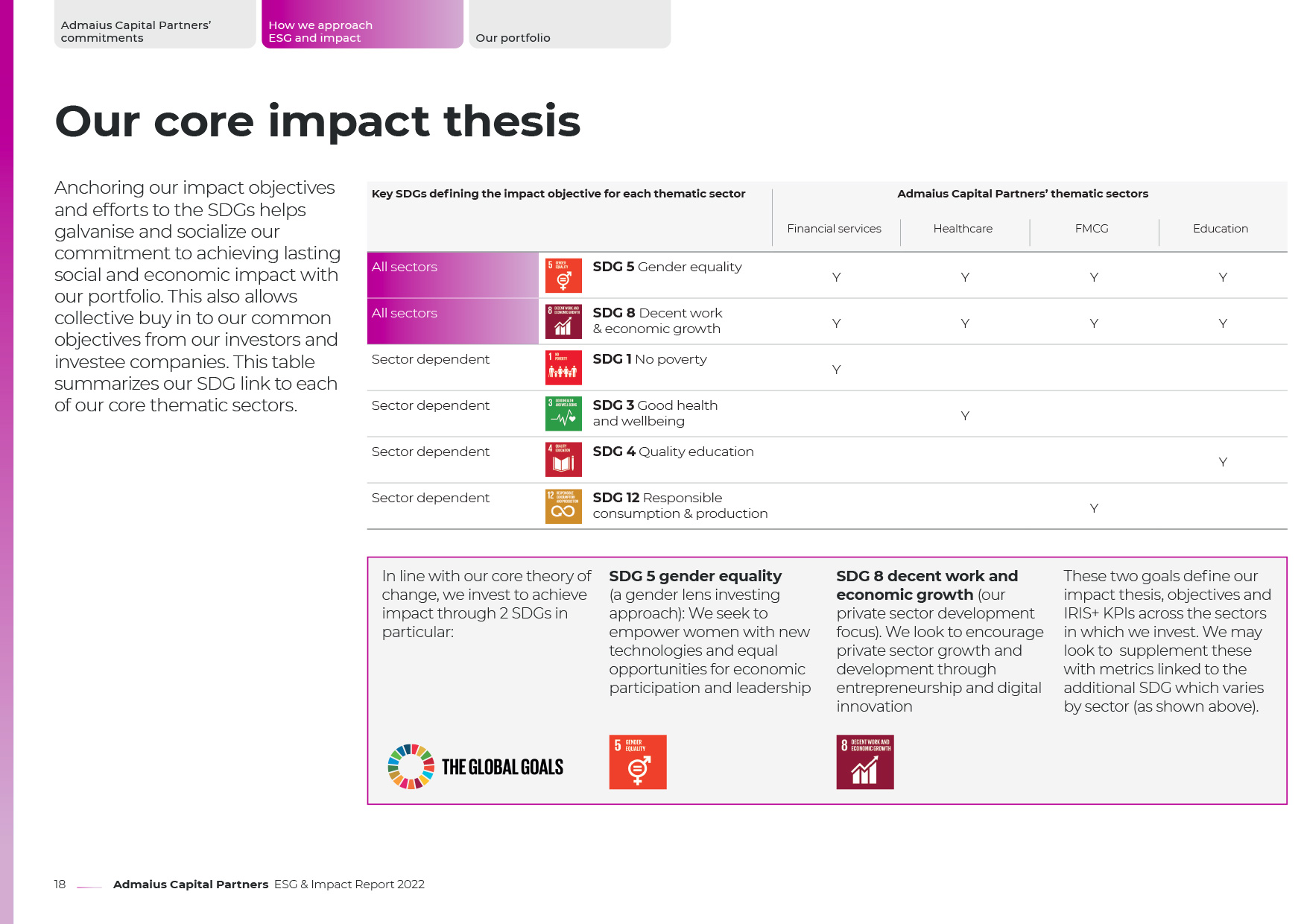

Conscious Impact in Mid-cap Regional Champions

We seek to empower management, employees and stakeholders, investing in companies with African ownership.

These are businesses deeply embedded in their ecosystems, capable of adapting.

Sustainability for Success

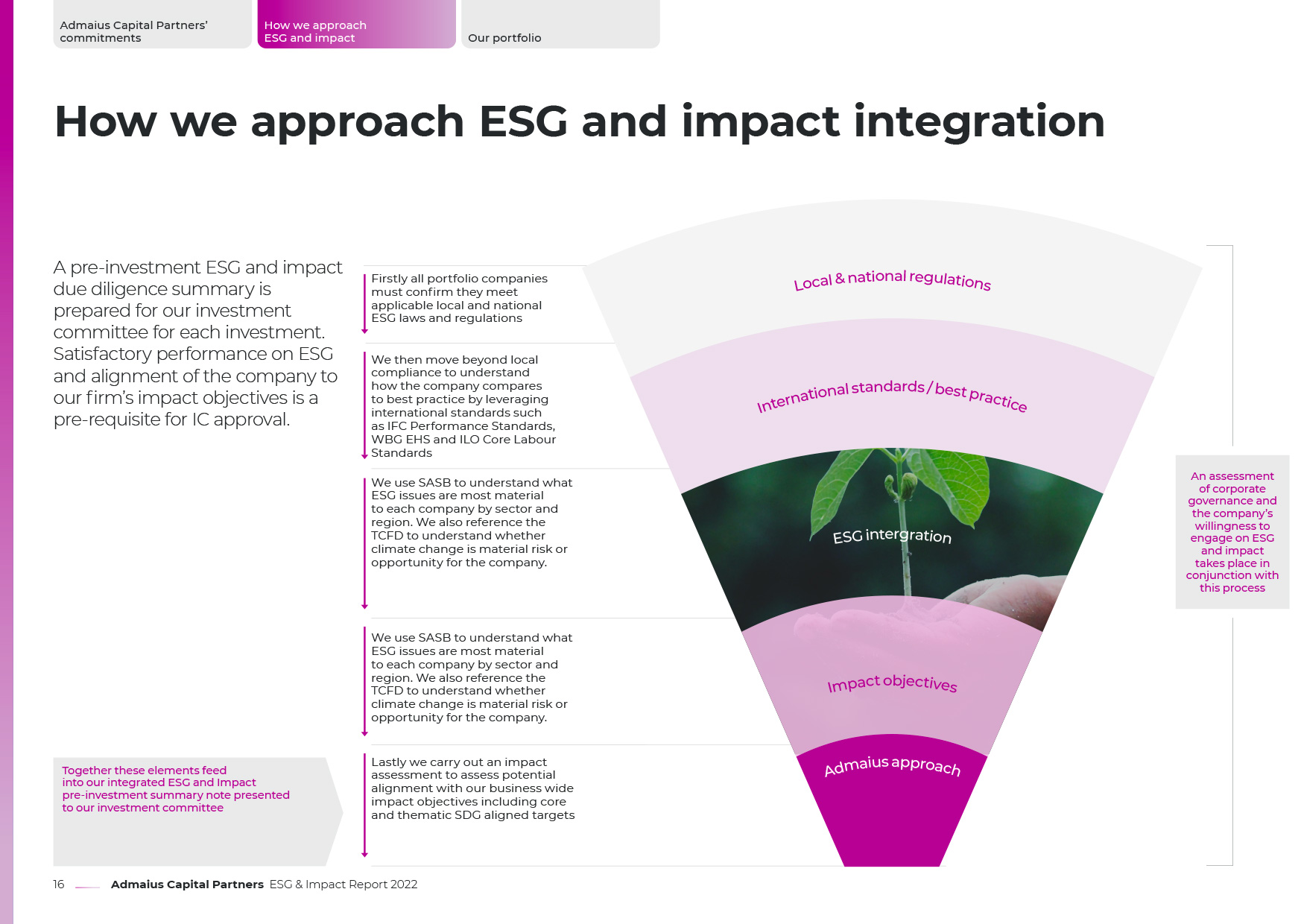

Admaius Capital is integrating sustainability into businesses to deliver holistic, long-term success for people, planet and profit. Admaius does this by working with businesses to systematically integrate environmental, social and governance (ESG) factors into their business strategy for sustainable results. For us, this commitment moves beyond mere fiduciary duty.

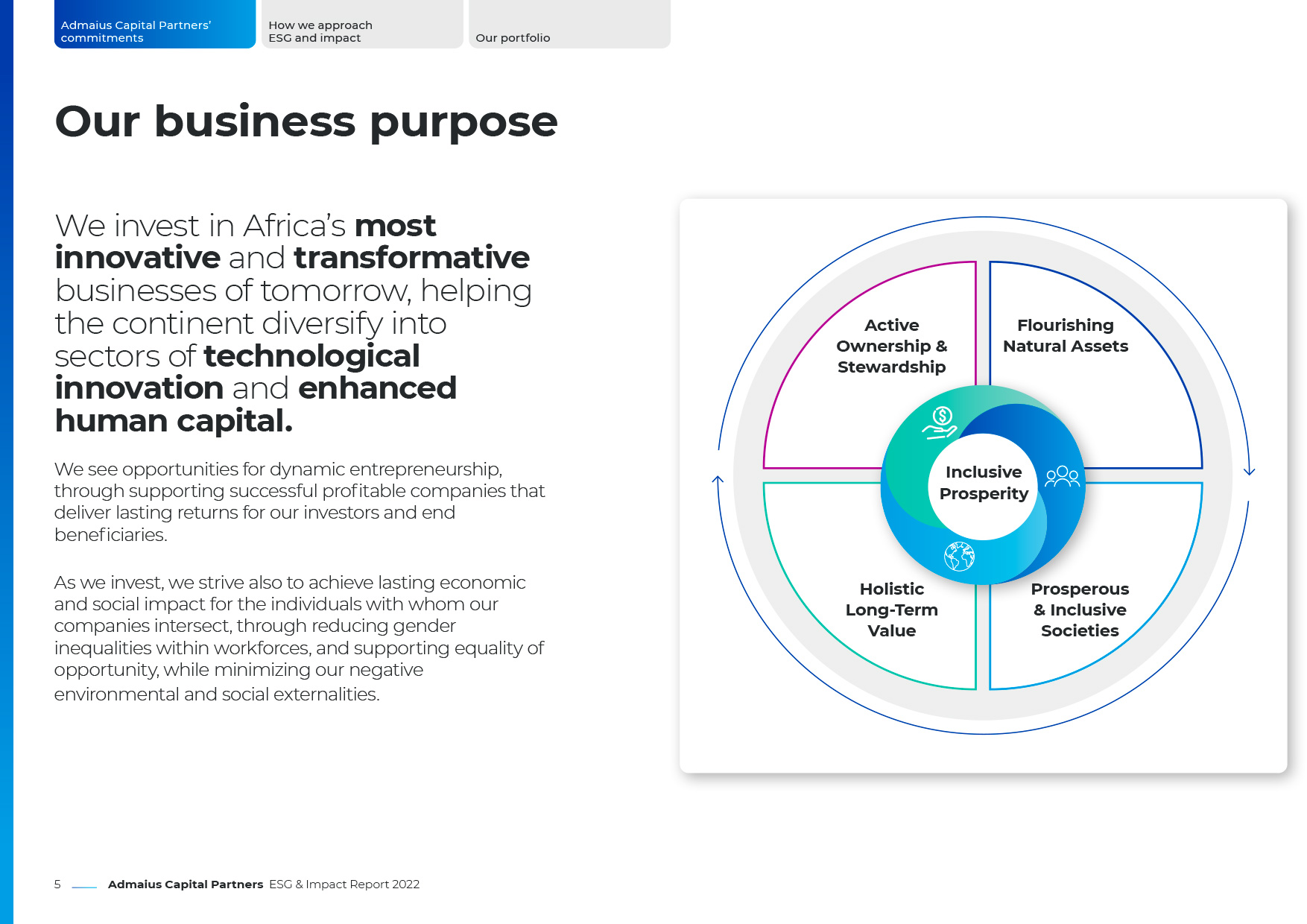

Purposeful Sustainability

To enable inclusive and flourishing societies in harmony with our natural environment across our markets of operation while simultaneously delivering market-leading returns.

Business Model and Value Proposition

We take an active ownership and stewardship approach by investing in strong management teams who believe in the triple bottom line approach of people, planet and profit.

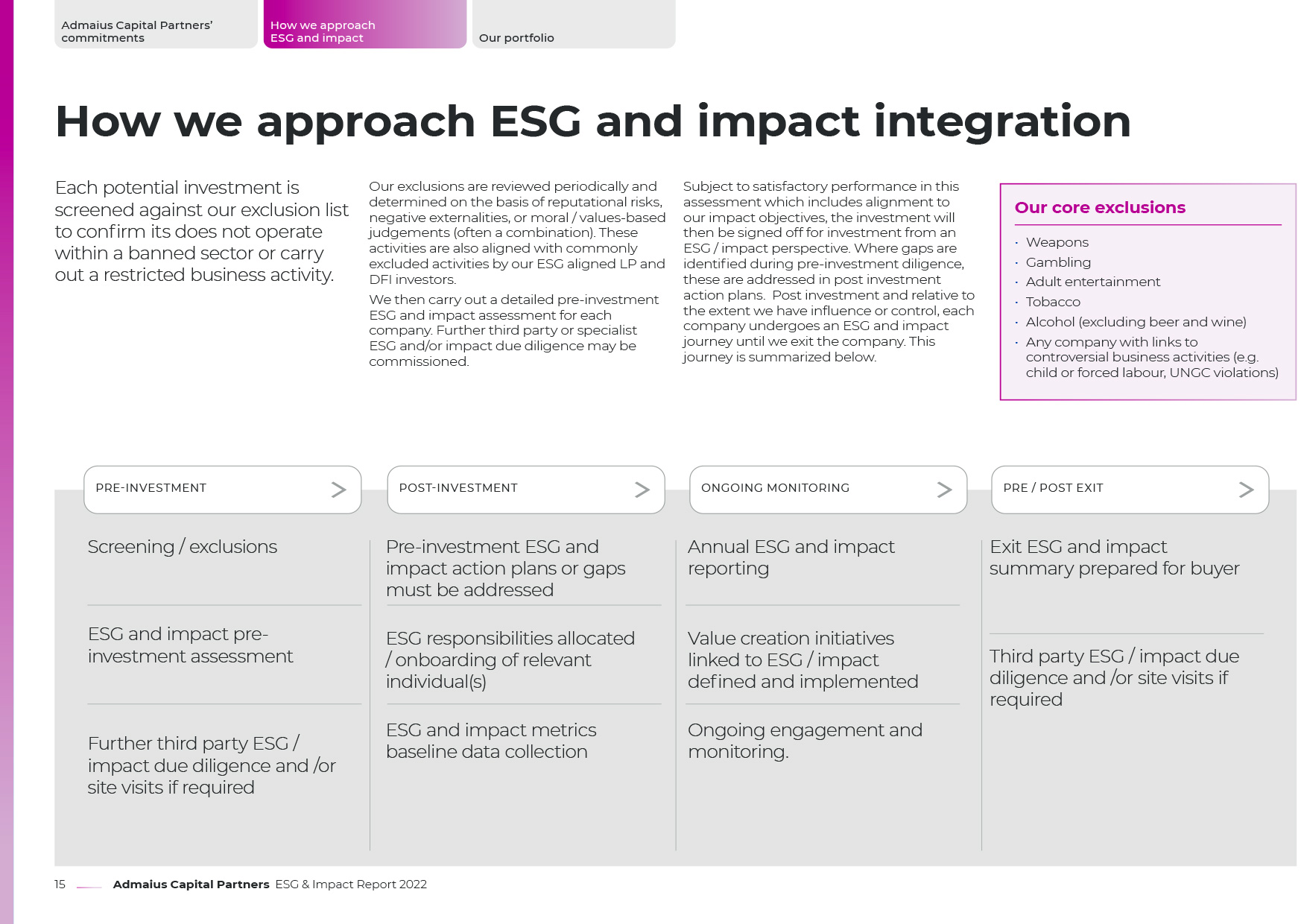

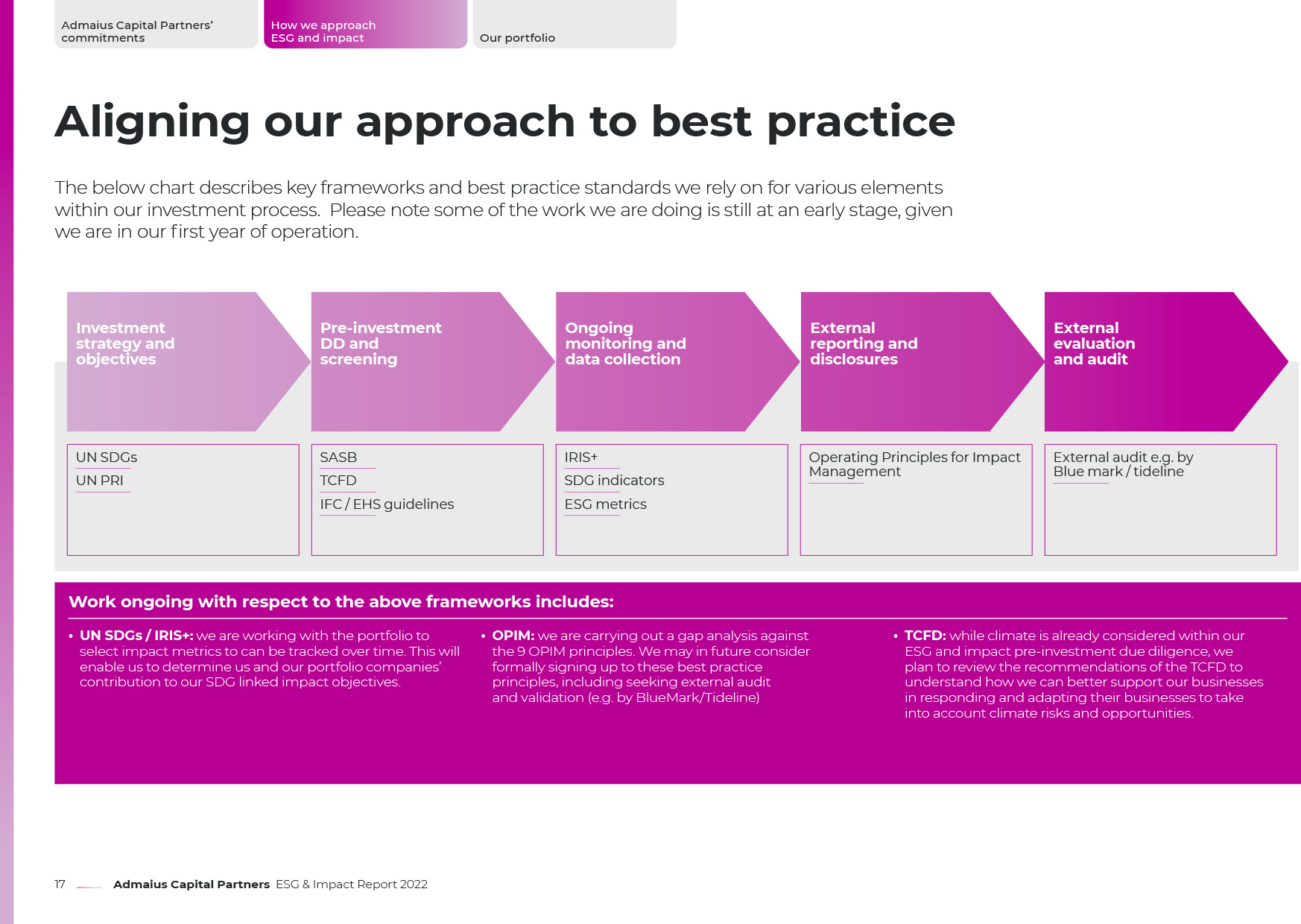

We incorporate best-in-class ESG standards and principles across our investment process. This includes materiality assessments for each of our portfolio companies. Our robust investment process is also augmented by a strong governance framework and ethical standards.

We believe this approach will enable us to identify and deliver on ESG improvements and value-add opportunities.

We are institutional

Fully committed to Africa, with an African investment team built on the foundation of an institutional mindset.

These are our home markets we are contributing to impacting.

Capital & Accountability

Our investors and partners are aligned in providing significant and repeat capital to grow thriving businesses for the long term.

That requires financial returns as well as operating performance to get to meaningful scale.

Further, to unlock swift growth and improvement of businesses, the team brings strong expertise, networks and critical technology.

Conscious Impact in Mid-cap Regional Champions

We seek to empower management, employees and stakeholders, investing in companies with African ownership.

These are businesses deeply embedded in their ecosystems, capable of adapting.

Sustainability for Success

Admaius Capital is integrating sustainability into businesses to deliver holistic, long-term success for people, planet and profit. Admaius does this by working with businesses to systematically integrate environmental, social and governance (ESG) factors into their business strategy for sustainable results. For us, this commitment moves beyond mere fiduciary duty.

Purposeful Sustainability

To enable inclusive and flourishing societies in harmony with our natural environment across our markets of operation while simultaneously delivering market-leading returns.

Business Model and Value Proposition

We take an active ownership and stewardship approach by investing in strong management teams who believe in the triple bottom line approach of people, planet and profit.

We incorporate best-in-class ESG standards and principles across our investment process. This includes materiality assessments for each of our portfolio companies. Our robust investment process is also augmented by a strong governance framework and ethical standards.

We believe this approach will enable us to identify and deliver on ESG improvements and value-add opportunities.

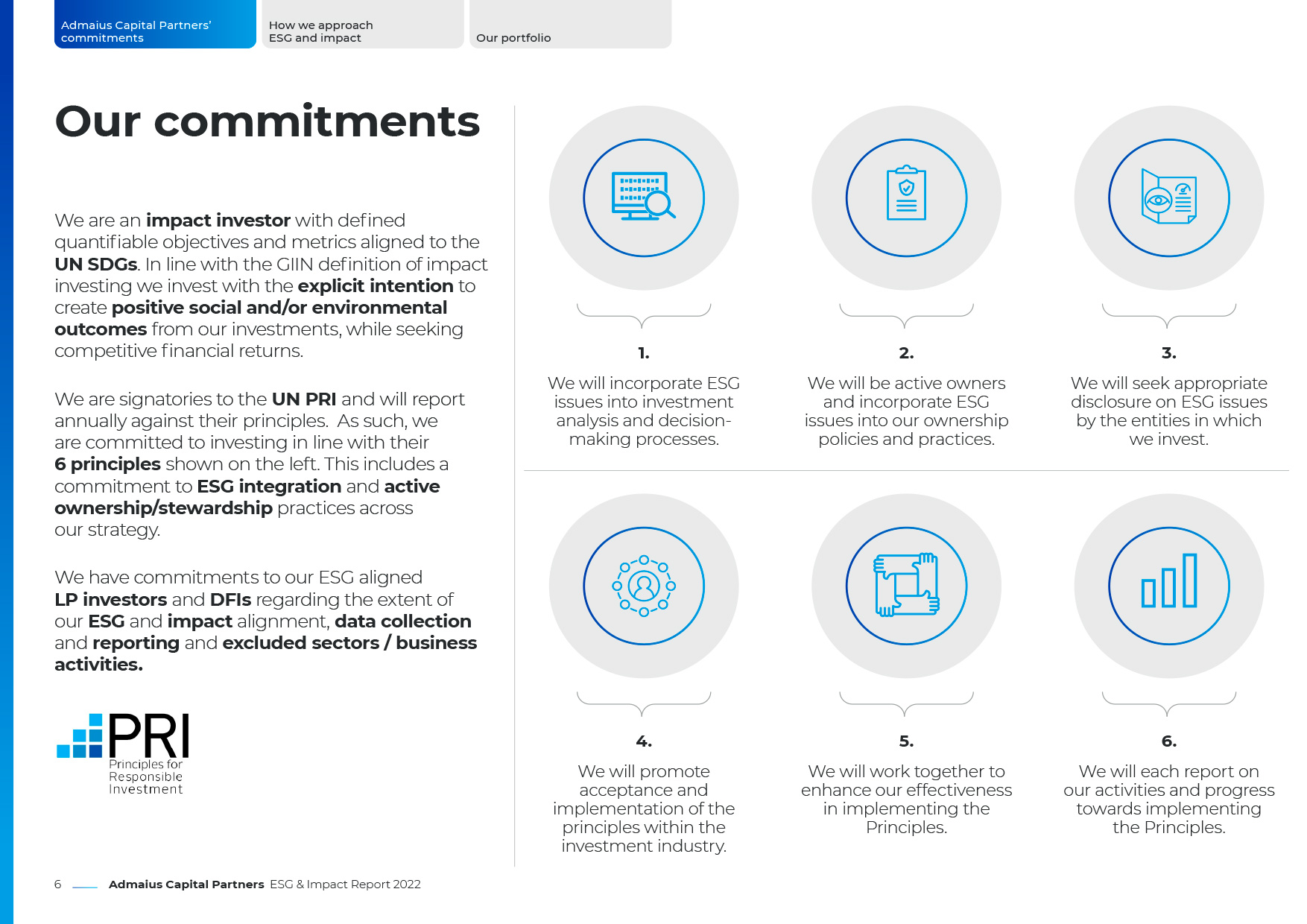

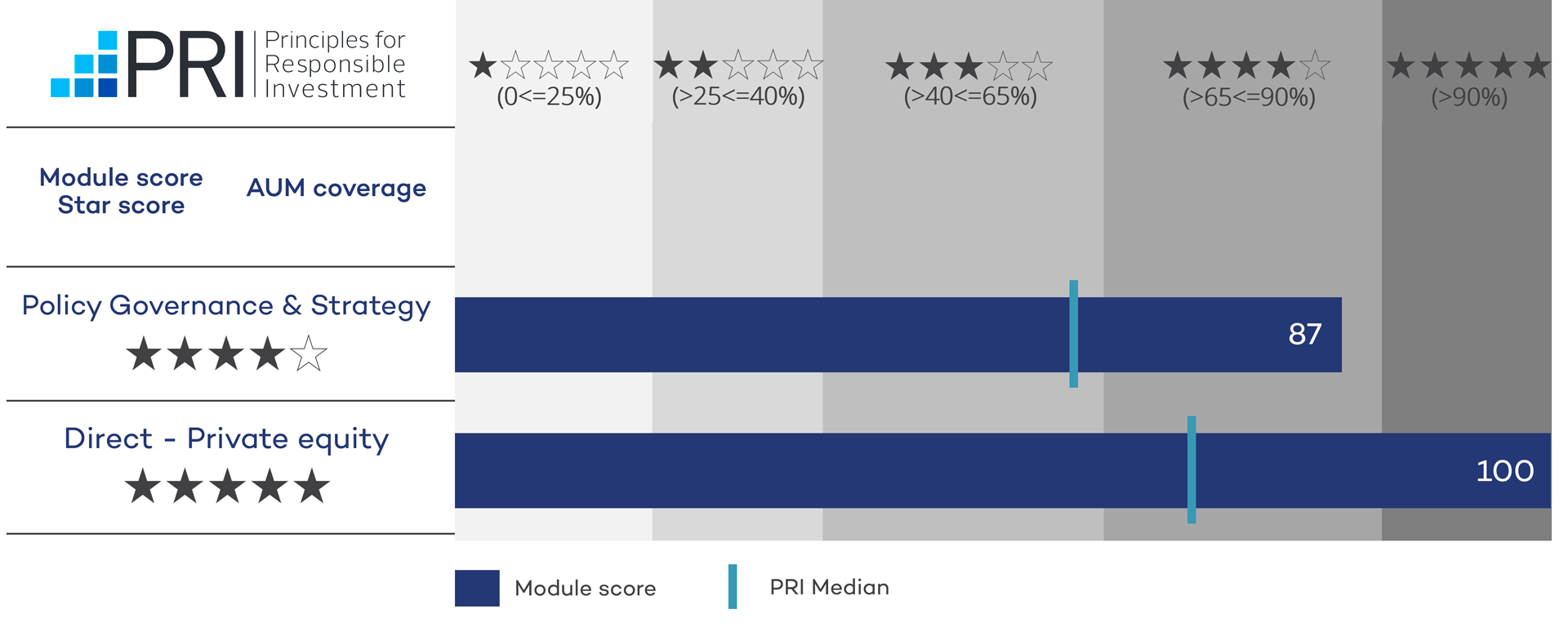

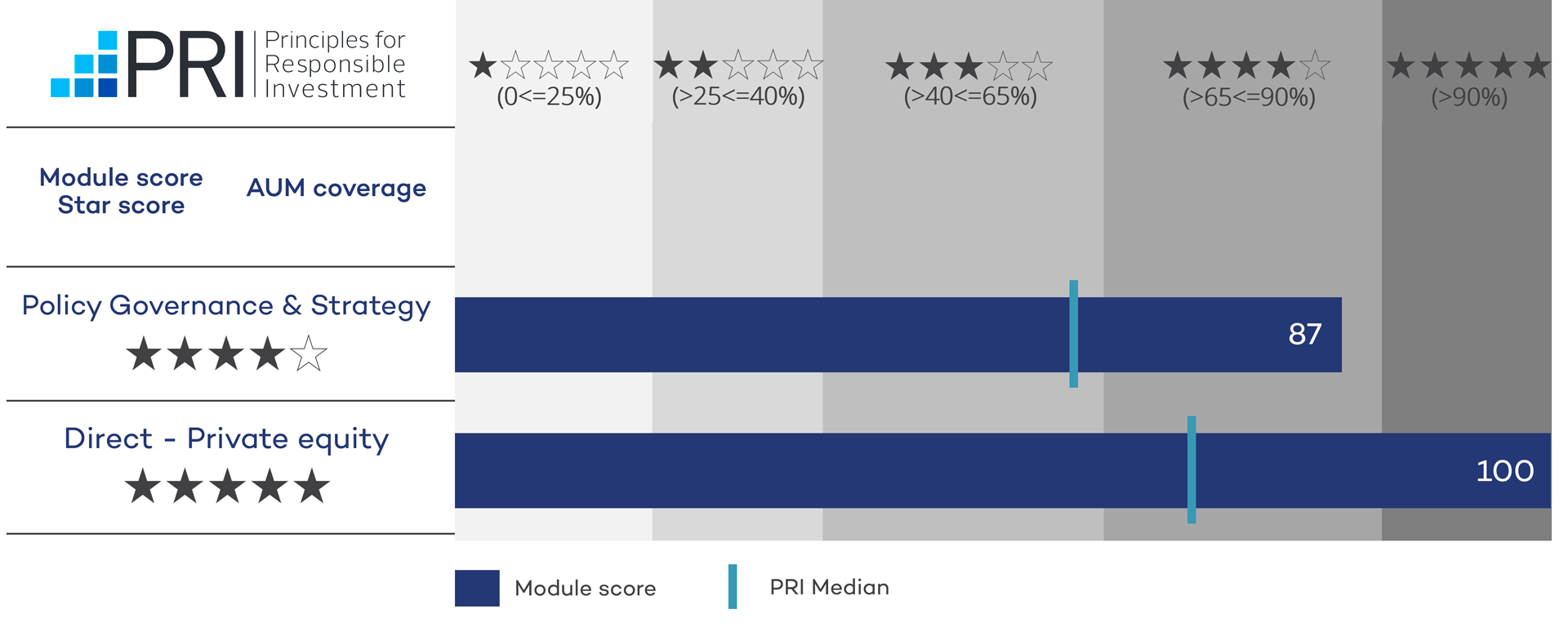

Admaius joined the UN PRI in 2022 and is firmly committed to investing in line with its six important principles

For 2023 our inaugural reporting year the Firm performed above the median for both core modules receiving:

We are proud to announce our endorsement of the UN PRI's Advance initiative, a collaborative effort focused on addressing human rights and social issues through investor stewardship.

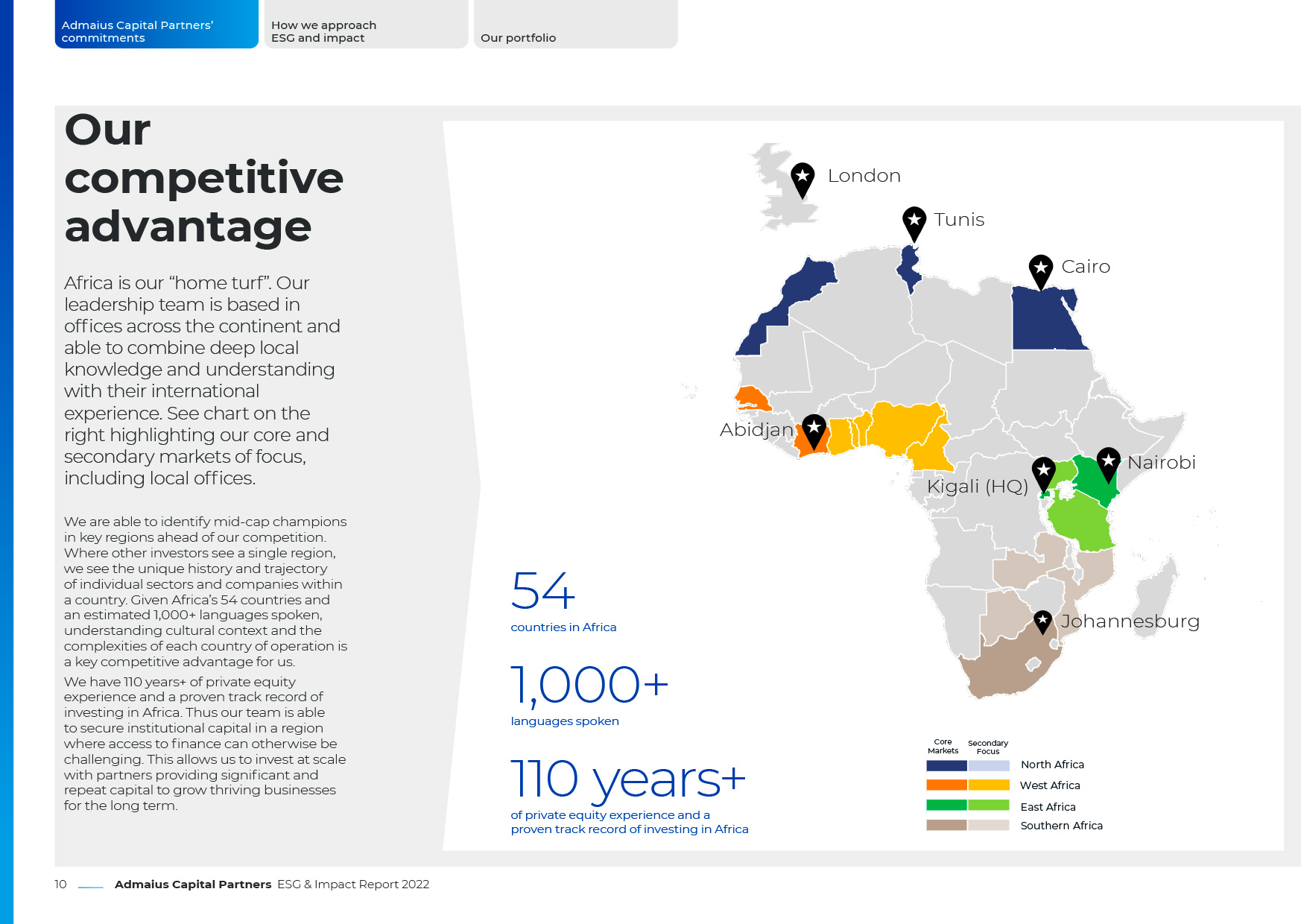

Diversity and local knowledge integral to success

Admaius blends local knowledge with international experience to attract new capital to Africa and create long-term value for our portfolio businesses.

This can only be achieved through a commitment to diversity at every level of the organisation. It is essential that we celebrate our differences so that we, and our portfolio businesses, can benefit from what makes each of our investment and business specialists unique.